7 Steps: How to Turn $5 per Month Into Lifetime Income for Your Child

A warm and welcoming guide for parents. As a parent, you've probably wondered: "How can I give my child the best financial start in life?" The answer might surprise...

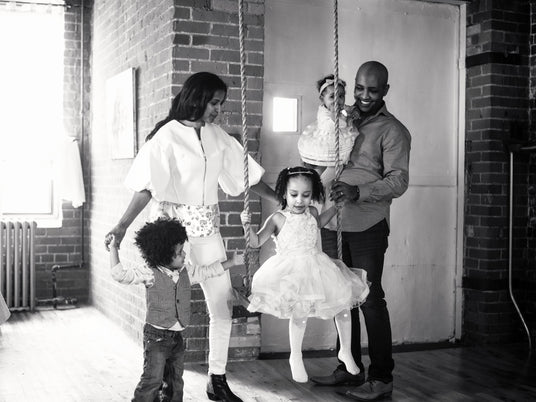

Secure and Protect Your Children's Future. Turn as Little as $5/month into a Lifetime of Living Benefits.

Purchasing an annuity for your child or grandchild can be a thoughtful way to provide them with financial security in adulthood. Plus, by placing assets into an annuity and naming them as the Annuitant (beneficiary) to the contract, you can avoid having those assets go through the costly and time-consuming probate process when you die. When and how your loved one receives the money will depend on how you structure the annuity contract.

Whether you want to start growing your retirement, or turn your child's savings into future lifetime income, an annuity is a long-term retirement planning tool that can be a cornerstone of your family's financial plan. An alternative to, or in addition to an IRA/Youth Roth IRA, it can help you protect and grow you and/or your children's retirement nest egg, or you can turn it into guaranteed lifetime income.

As the name suggests, it is insurance designed for a child’s whole life. Most children’s whole life insurance products build guaranteed cash value to help safeguard and nurture their future. Children’s whole life is typically designed for children age 0 days to 18 years, has lower face amounts (can be increased in the future) and premiums that remain the same for their entire life.

Protecting and preparing your children and grandchildren for life is one of the most important things a parent can do for their family. Starting as low as $3 per month with no medical exams and just a few medical questions and a simplified application. It can be a timeless, sustainable reminder of how much you care for the ones you love, plus some additional peace of mind for you.

Indexed universal Life (IUL) insurance is a type of permanent life insurance, which means it can last your entire life and builds cash value. An IUL policy allows for cash value growth through an equity index account, unlike other universal policies that only grow cash value through non-equity earned rates. Like with all universal life policies, once you've built up enough cash value, you can use it to lower or potentially fully pay for your premium without lowering your death benefit.

Like traditional universal life policies, IUL policies include a death benefit and a cash value account. An IUL policy's cash value grows based on a stock index (a set grouping of various stocks) instead of only through non-equity earned rates (fixed interest). Like universal life, IUL also offers the flexibility to adjust your premium as the cash value grows, with the potential to eventually achieve a zero-cost policy in which all premiums are paid for by your built-up cash value.

We access many different products through our partnership with the nation's most reputable insurance carriers to help you find the products that will best serve the needs of your children and family. Ask about:

Whatever type of insurance is right for you, the sooner you decide, the more affordable your insurance can be. Younger and healthier people are less risky to insure, and that means they can get lower premiums – and for some products, lock those lower premiums in for life.